Why Expense Tracking Using Software Changes Everything

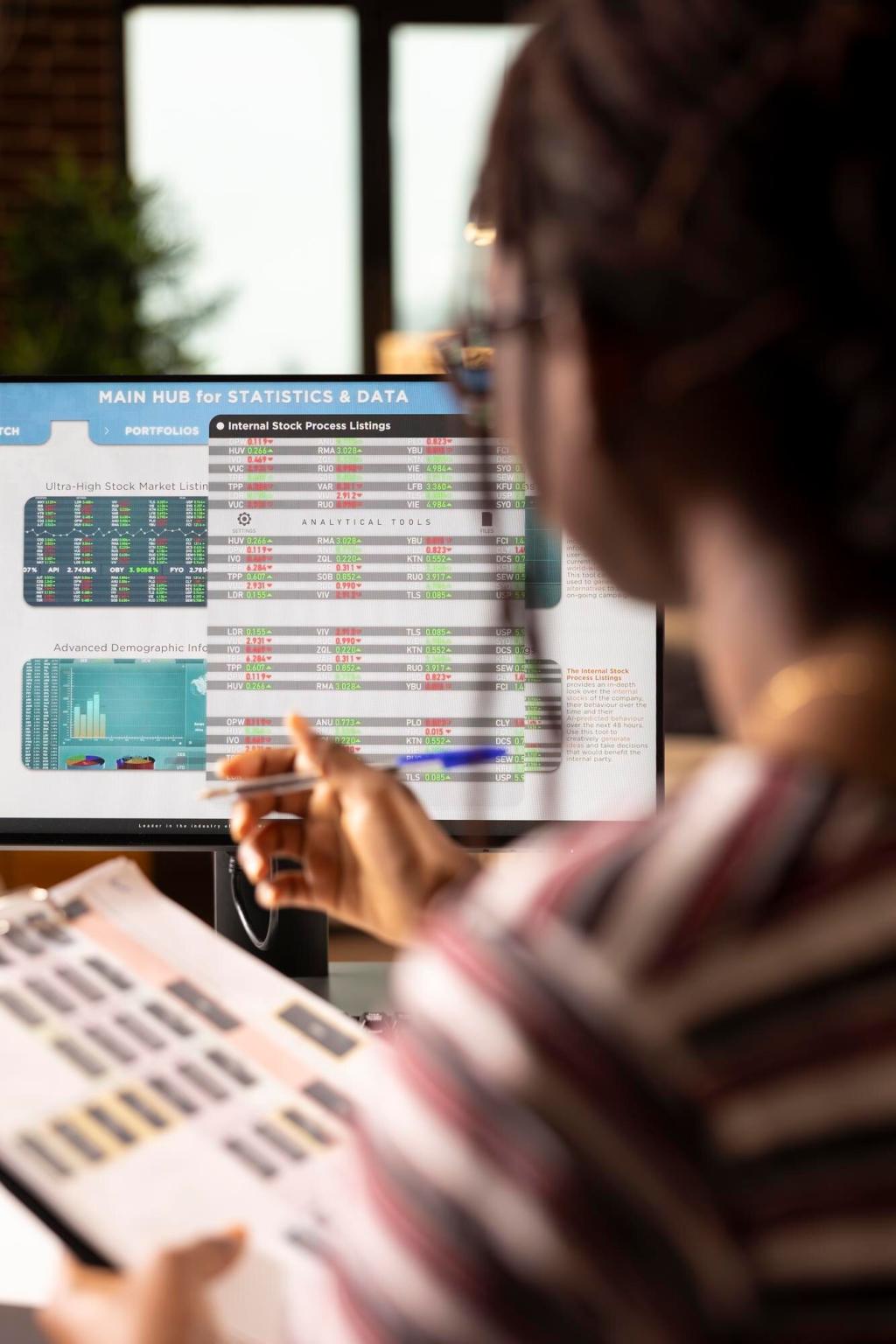

Before using expense tracking software, many of us misjudge spending by hundreds every month. A categorized, timestamped feed ends the guesswork, surfacing blind spots—like subscriptions and delivery fees—that slowly drain momentum. Tell us the category that surprised you most.

Why Expense Tracking Using Software Changes Everything

When your transactions sync automatically, awareness happens in near real time. You notice patterns mid-month, not after it’s too late. That gentle clarity creates confidence, helping you choose cooking over takeout or pause a purchase until payday. Share your best mid-month pivot.

Why Expense Tracking Using Software Changes Everything

Software turns data into direction: monthly trends, alerts near budget caps, and cash flow timelines. Instead of reacting to overdraft warnings, you plan ahead and stay calm. Comment with your planning routine and subscribe for our proactive budgeting checklist.

Why Expense Tracking Using Software Changes Everything

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.